President Donald Trump’s trade wars may turn out to be political suicide

Auto sales are falling, workers are being laid off in droves, and manufacturing is in reverse gear. I am not writing about India but about the US. General Motors has cut thousands of jobs across the Midwest. US Steel plans to lay off 200 workers in Michigan. The US Purchasing Managers’ Index (PMI), a broad indicator of industrial demand, fell in August for the first time in years. Temporary jobs, a normally reliable indicator of activity, have fallen by 30,000 since December.

The US GDP is still growing and unemployment is very low. Hence, some members of the Federal Reserve Board remain optimists. But perhaps the US economy has peaked, aided by US President Donald Trump’s tax cuts in 2018, and is now heading downward.

Drag Effect

Some sectors like shale oil continue to boom. The Fed could cut interest rates sharply, just as central banks are doing across the world to fight the slowdown. But GDP growth has decelerated to 2% in the second quarter of 2019, from 3.1% in the first quarter. Whether or not the US suffers outright recession in 2020, it looks headed for a major economic slowdown, having already slowed the whole world economy.

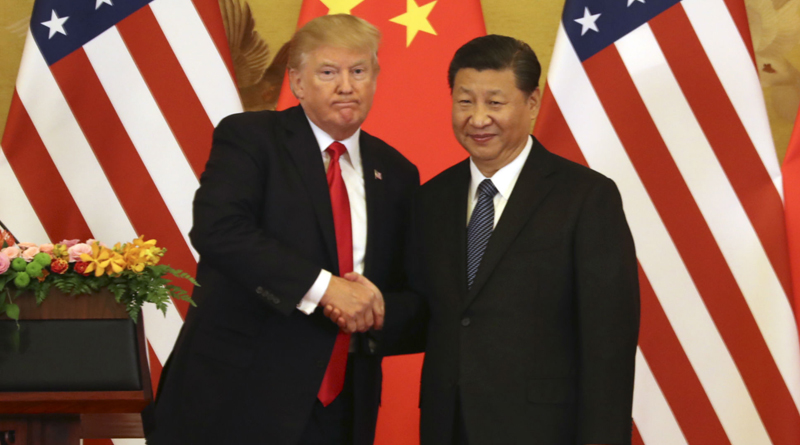

Trump has launched a major trade war with China, lesser wars with Europe, and minor wars with India and (believe it or not) even with tiny Rwanda. He has placed sanctions on Iran, Russia and Venezuela, and is now threatening his Nato ally Turkey for having bought Russian missiles.

Trump is the overwhelming reason for the global economic downtrend. Brexit comes a distant second. The foundations of the international economy are suddenly shaking, and nobody knows which rule will fall next. Economic uncertainty has led to the slashing of investment as well as auto sales.

Auto sales are discretionary. Buyers typically postpone fresh purchases in uncertain times. That is now hitting auto sales across the globe. In India, auto sales are down 31.6 % and two-wheeler sales 22% in August. Consumers everywhere have becoming cautious about spending, and the resultant fall in demand threatens a global recession.

Ironically, this could mean that Trump is committing political suicide. He could lose the next election. His trade wars are popular with core supporters. His tax cuts boosted the US economy last year, though the impact is now tapering off. Despite his crudity, racism, mendacity and bewildering inconsistencies, his party has rallied strongly behind him.

By contrast, the Democrats have a leadership problem, with dozens of potential presidential candidates but no convincing ones. The leading Democratic contender is the colourless Joseph Biden, Obama’s former vice-president.

Trump has reasons for optimism. The vast majority of US presidents get re-elected for a second term. However, economic slowdowns can halt presidential re-elections, as happened to George Bush Sr in 1992. This carries the warning that a recession or serious economic slowdown in 2020 may cost Trump dearly.

Four industrial states in the Midwest were crucial for his victory in 2016: Michigan, Wisconsin, Ohio and Pennsylvania. These were once considered safe Democratic states, but Trump won all four in 2016. He promised to rejuvenate US manufacturing using tariffs and other weapons against ‘unfair trade’ by China and other trading partners.

Metal Asylum

In practice, his tariffs have not worked well. A 20% duty on steel and aluminium may have helped these metallic industries, but it has also meant higher input prices for industries using these metals, including autos. Critics always said that, whatever the short-term gains, such protectionism would be bad for the economy in the medium term. Those critics now look vindicated. Trump’s promises of rejuvenating manufacturing look hollow as steel and auto plants lay off workers. This means that in 2020, he may well lose all these four industrial states that led him to unexpected victory in 2016.

The yield curve has inverted in the US. That is, the yield on 10-year gilts has fallen below that on two-year gilts. Normally, longer-term bonds carry higher interest rates. When the longterm yield falls below short-term rates, that means lack of industrial demand for 10-year loans to invest, and that shortfall in investment typically leads to a recession. Some studies suggest that every recession since World War 2 has been preceded by a reversal of the yield curve, though there may be a lag of up to 18 months. The correlation is very strong.

Other studies suggest that the inversion of the yield curve can be temporary, a blip. Trump must be hoping so. Yet, he is in severe electoral danger. If the 2018 gains of his tax cuts are now getting offset by the consequences of trade war, he has none to blame but himself.

China has been hit hard by the trade war. So, President Xi Jinping may be tempted to strike some sort of deal with Trump, even if suboptimal. He should resist that temptation. Come 2020, the trade war may well be Trump’s nemesis. By refusing to compromise right now, Xi can strengthen forces that will elect a new US president with greater economic sense.