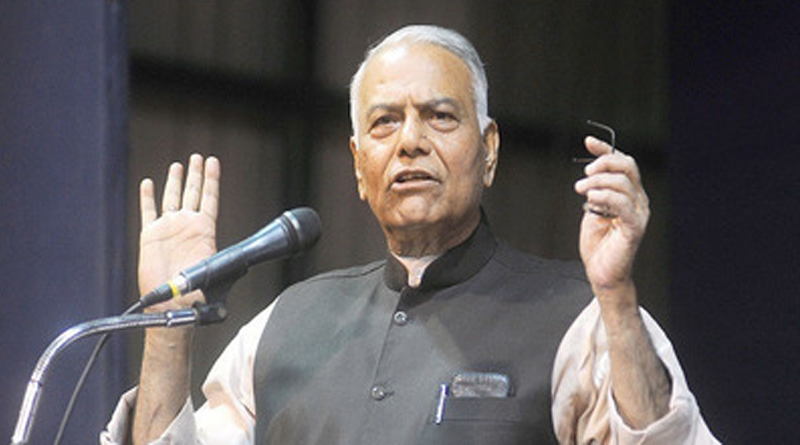

New Delhi has been abuzz with talk of a big fiscal spending package of maybe Rs 40,000 crore to `kick-start\’ the economy, which has slowed for five quarters in a row. Adding to the excitement has been the virulent castigation of economic policies (especially demonetisation and the red tape accompanying GST) by former BJP finance minister Yashwant Sinha. He warns that the economy is spiralling downwards to a hard landing.

While the economy faces serious problems, these cannot be remedied by a fiscal spending spree.Finance minister Arun Jaitley must ignore panicky notions that a crash spending package can remedy structural problems that need deep reforms. Export stagnation for three years, a banking system bur dened with huge bad debts, and high real interest rates have dragged down the economy . None of these can be rectified by a spending spree.

Nobody should mistake Yashwant Sinha\’s criticisms as a call for a fiscal boost. He was always a fiscal hawk, convinced (quite rightly) that the longterm gains of prudence vastly outweighed the short-term gains of a spending spree. He worries about the inspector raj that is returning with GST paperwork and a huge expansion of income tax investigations. His warnings have a core of truth: GST paperwork is monstrously tough for small companies, and the notion that our notoriously corrupt income tax can become the standard-bearers of tax honesty is bound to evoke laughter. Yet both GST and improved tax compliance are essential long-term goals, despite short-term costs.

India already has a consolidated Centre-State fiscal deficit of 6-7% of GDP , the highest by far of any major economy . Many countries have gone bust with a lower fiscal deficit, and India survives only because it has a high savings rate. Deficits need to be reduced, not expanded.

Indeed, steady reduction of the fiscal deficit in recent years has improved India\’s credibility greatly , reduced the rate at which it can borrow abroad, and attracted foreign investment. Why throw away these gains for the tiny benefits, if any, of a spending spree?

The Central fiscal deficit was supposed to be reduced to 3% of GDP by 2008, but that goal has been postponed by a full decade. Jaitley had earlier promised to cut the fiscal deficit to 3% this year but ultimately opted for 3.2%, presenting the additional 0.2% as a fiscal boost to accelerate the economy .That failed, and this should surprise nobody . Even for an efficient economy , an additional 0.2% of investment will increase GDP by just 0.05%, too small to even measure accurately. Meanwhile it has negative consequences like reduced foreign confidence in India, higher dollar outflows, and higher dollar borrowing rates. The same problems will afflict another fiscal boost of Rs 40,000 crore. Too many people see a spending spree as a quick Keynesian way of producing rapid growth. Keynes advocated a fiscal boost when a recession struck, causing a sudden shrinkage of demand. Conversely, he advocated a budget surplus during a boom.This leaning against the current stage of the business cycle is called contra-cyclical fiscal policy.

But Rathin Roy of the National Institute of Public Finance and Policy says research has failed to uncover any business cycle in India. So, contracyclical policy in India is conceptually dubious or groundless. It is far better to stick to prudent longterm fiscal goals than attempt to fine-tune fiscal deficits on the erroneous notion that economic ups and downs can so easily be manipulated.

In theory, spending a quick Rs 40,000 crore extra on infrastructure sounds attractive. In practice infrastructure projects have faced multiple delays and problems leading to bankrupt builders and bad debts of lakhs of crores. Experience shows that the government takes a long time to spend additional public funds productively . Infrastructure spending needs to rise steadily , not as a short-term stimulus.

The economy has been hit by short-term shocks imposed by demonetisation and the launch of GST.But the shocks will gradually fade away , resulting in a bounce-back of growth in 2018. There is no evidence of a coming hard landing, as predicted by Yashwant Sinha.

Nor will 8% growth return sustainably without major reforms. The right way to accelerate growth is to relentlessly increase productivity . This implies reforms that ease business hassles, greatly improve all government services, and instill confidence.Export stagnation must be checked by an aggressive exchange rate policy , lower interest rates, and trade facilitation. Massive bad debts of banks must be tackled. This means a long hard slog, not a quickie fiscal boost.