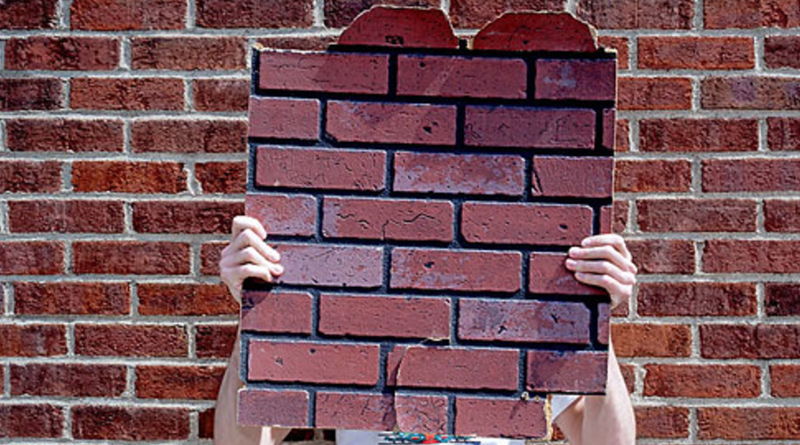

America Walling Itself In

Why US President Donald Trump’s ill-advised protectionism is bound to fail

Swaminathan S Anklesaria AiyarIn pursuance of his ‘America First’ policy, US President Donald Trump has imposed import tariffs of 25% on steel and 10% on aluminium. Earlier, he imposed a 30% tariff on solar panels. On coming to power, he scrapped the Trans-Pacific Partnership (TPP) negotiated by his predecessor Barack Obama, and forced a re-negotiation of the North American Free Trade Agreement (Nafta).

Outraged that the US runs a huge current account deficit (CAD) of nearly $500 billion a year, he blames this on unfair trade by others who heavily tax, or otherwise discourage, imports from the US, while having easy, cheap entry into US markets. He protests most about China, but takes on even his own allies.

Davidson and Goliath

Trump looks certain to fire many more protectionist salvos. When European leaders threatened to retaliate against high US steel tariffs by considering higher European tariffs on Levi’s jeans, Harley-Davidson motorcycles and bourbon whisky, Trump tweeted immediately that in that event, he would jack up import duties on European cars.

He knows that the US is such a mighty economic and security power that it can extract a lot with impunity from other countries, who will be reluctant to form a joint front to retaliate. No individual country is strong enough to retaliate unilaterally. Yet, if pushed beyond a point, retaliation from Europe and China will happen, and could spark a general trade war that hits all countries, including India.

Trump’s latest duties on steel and aluminium violate the tariff limits the US has agreed to under the World Trade Organisation (WTO). He is simply wrong in saying that other countries levy enormous duties while the US does not.

WTO negotiations over the years have ensured reciprocity from all rich countries, though poor countries are allowed preferential tariff treatment. China was undoubtedly guilty of currency manipulation in the 2000s. But recent analyses by the International Monetary Fund (IMF) suggest that has ended some time ago.

The main reason for the big US CAD is not unfair trade. It lies in the relatively low savings rate of the US. Non-economists may find this difficult to comprehend, but CAD is equal to the difference between a country’s savings and investment. If investment exceeds savings, that implies a net inflow of goods and services to bridge the gap.

The mirror image of the investment-savings gap is CAD. This mathematic equality is non-obvious to the lay reader, but is a reality.

This means a country with a CAD cannot solve its problem by raising import duties. Curbing imports of a particular commodity, or from a particular country, will not change the investment-savings gap. Hence, it will not change the overall CAD.

Trump can force a reduction of his trade deficit with, say, China by imposing curbs. But that will exactly be offset by additional imports from other countries, as long as his investmentsavings gap remains unchanged.

Is the US trying to reduce that gap? Alas, no. Since the crash of 2008, the US has employed enormous fiscal and monetary stimuli totalling trillions of dollars to revive the economy. Such massive stimuli have boosted demand. But that means import demand too. Expansionary fiscal and monetary policies will, other things remaining equal, typically increase CAD.

CAD Camaraderie

Ignoring this elementary economic reality, Trump has just slashed corporate and other taxes, increasing the fiscal deficit and boosting demand, even though the economy is already growing fast. This fiscal boost is guaranteed to boost imports overall, even if Trump squeezes some items and some countries.

Ironically, if he succeeds in his aim of increasing US investment, this will (other things remaining equal) increase his investment-savings gap and, hence, also the US’ CAD.

India has many businessmen and politicians who, openly or tacitly, want a protectionist ‘India First’ policy similar to Trump’s ‘America First’ approach. This will help some industries, but at the expense of others.

Higher import duties mean higher prices. That will leave consumers with less money for other items. So, even as protection stimulates demand for protected items, it hits other items. Protection, thus, becomes a form of cronyism where producers getting higher import tariffs make money at the expense of other producers who are already competitive.

Consider the consequences of higher steel duties in the US. They will certainly help integrated steel plants. But some steel companies import steel slabs for conversion into rolled products, and will be decimated by the tariff.

All steel-using industries, including the automobile industry, will be squeezed by higher input prices, and their ability to export or compete with imported goods will be eroded. A modern steel or aluminium plant is very capital-intensive, and employs few people. Trump will help these lowemployment industries at the cost of higher-employment ones.

The US is spending more than it earns — that is what the investmentsavings gap implies. The real solution lies in a higher US savings rate, or higher US productivity (that enables it to produce more with less investment). Alas, when things go wrong, it is easier to blame foreigners than oneself.