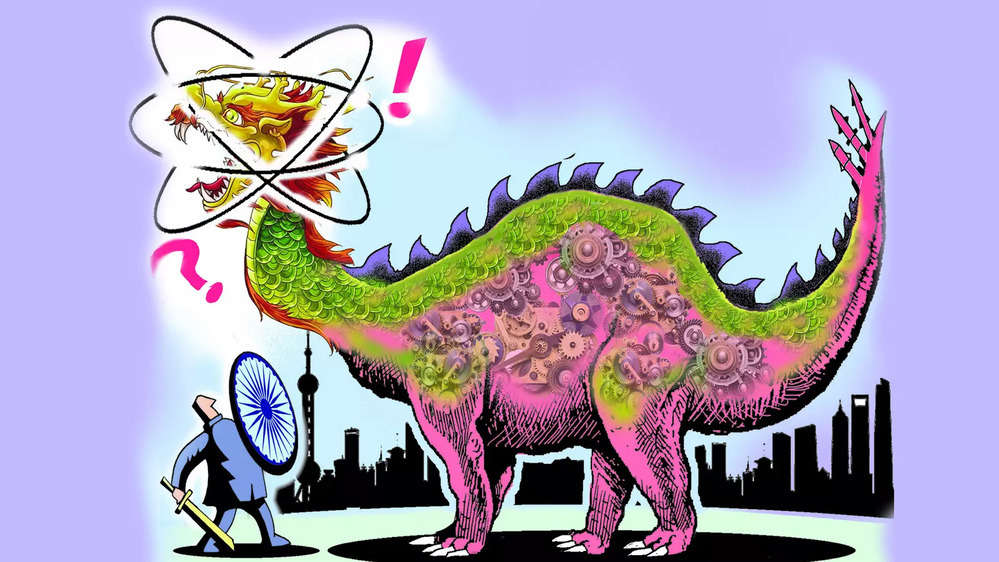

This year’s Economic Survey, overseen by the chief economic advisor, has suggested a major but overdue policy change, aiming to attract foreign direct investment from China. Many economists, me included, will cheer. But the proposal has to overcome strong resistance from the security establishment. Balancing economic and security needs is always tricky.

The US is even more upset with China than India, and has stopped exports of high-tech equipment that can militarily help Beijing. But treasury secretary Janet Yellen has formulated a policy of ‘high fence, small yard’. That is, the US will identify areas where connections with China will impair security, and define this narrowly rather than broadly. This will be the ‘small yard’. Surrounding it will be high tariffs and outright bans, the ‘high fence’. All else will be open.

All Chinese applications undergo a screening process with so many rejections that the message is clear — you are not welcome here

Logically, India should follow a similar policy. Alas, in practice, India’s ‘small yard’ seems to mean ‘every single yard’. There is no specified Lakshman Rekha.

India’s security establishment has long opposed Chinese FDI, saying this will send the wrong signals to China, which transgressed on Indian territory in the Galwan Valley, Ladakh, leading to a military clash causing the death of 20 Indian soldiers in 2020. After this, the security establishment said, economic ties with China could not be business as usual.

No Chinese investment is now allowed through the automatic route available to other countries, and all Chinese applications undergo a screening process with so many rejections that the message is clear — you are not welcome here. ‘No business as usual’ seems to have become ‘no business at all’.

Some years ago, Great Wall Motor Company, a conventional auto manufacturer, proposed a billion-dollar investment in India. It did not get clearance.

More recently, BYD, the biggest electric car company in the world — its sales exceed that of Tesla — proposed another billion-dollar investment. This included a mega-battery plant with cutting-edge ‘blade technology’. But this too was not cleared.Luxshare is one of the biggest Chinese companies in the Apple value chain. It makes wearables like Apple watches and Airpods. It had proposed to invest Rs 750 crore to become a major local supplier to Apple. Despite strong support from the Tamil Nadu govt, clearance has not come.

One official told the Economic Times, “Frankly, a large part of the supply chain of Apple has China origins. So, if we keep saying no to all of them, how will we ever manufacture here?” After trying to enter India for years, Luxshare is reported to have shifted its investment to Vietnam.

Will this really improve India’s security, or reduce clashes in Ladakh? The security establishment is either unaware or determined to ignore the fact that China is now the largest source of investible savings in the world, a role once played by the US. China also has some of the best global technology, being numero uno in e-vehicles, batteries, solar panels and windmills. All these are high-priority areas in India’s bid to curb climate change. Why keep out the best companies in such vital sectors?

In autos, India allowed investors from every country to enter. All the global companies came in, interacted with our ancillary companies, raised their technical skills, started R&D centres, and ended up making India a world hub for small cars and auto ancillaries.

We need a similar approach in key areas like e-vehicles and renewable energy. Get the best companies in the world to invest in India, including the Chinese ones. The concept of ‘China plus one’ refers to the aim of many global investors to diversify out of China into other developing countries. That’s fine, but China itself wants to diversify to other destinations.

The Economic Survey has an additional justification. “Focusing on FDI from China seems more promising for boosting India’s exports to the US, similar to how East Asian economies did in the past. This is because China is India’s top import partner, and the trade deficit with China has been growing. As the US and Europe shift their immediate sourcing away from China, it is more effective to have Chinese companies invest in India and then export the products to these markets rather than importing from China, adding minimal value, and then re-exporting them.”

The Survey says India has a big trade deficit with China. One way of reversing the flow would be Chinese investment in India. The dollars flowing out will flow back. And, hopefully, earn even more dollars by investing in export-oriented areas, such as Apple’s value chain.

Let the govt declare the precise limits of its security yard, and erect high fences there. Let all else be open to the world, including China.