A zillion criticisms of capitalism have come from the Left. But an increasing number are now coming from the Right. They come out with a ringing cry, ‘Joseph Schumpeter, where are you? We need you.’

Schumpeterians long for the churn of companies, with older, less productive ones dying, and being replaced by newer, more productive ones. This is the ‘creative destruction’ that the 20th-century Austrian political economist saw as the heart and soul of successful capitalism. That, says critics, has been thwarted by a constant expansion of the state, through regulatory overkill, non-stop stimulus and rescues in times of trouble. The result is mollycoddled corporations that are not allowed to fail, zombie banks keeping zombie companies alive and, hence, misallocation of capital that hits productivity.

In the long run, as Paul Krugman famously said, productivity is not everything, but is almost everything. If productivity goes, so does everything else. That, say the Schumpeterians, is what has gone wrong with capitalism. A good example of this line of argument comes from Ruchir Sharma’s new book, What Went Wrong with Capitalism.

The US Left, exemplified by Bernie Sanders and Elizabeth Warren, has long complained that the excesses of neoliberalism, hyper-globalisation and neglect of the working man explain what has gone wrong with capitalism. Schumpeterians say the problem is the other way round – of more and more state spending and regulation, less and less free markets.

Welfare spending in the US, taking all sorts of assistance into account, has soared to 30% of GDP. Not so long ago, this would have been viewed as manic socialism. The register of US federal regulations rose eightfold since 1960 to 180,000 pages. This is the very opposite of supposed neoliberalism.

Europe has gone the same way. European tax collection rose from 10% of GDP in 1910 to 47% by 1980, and is still there.

John Maynard Keynes advocated high fiscal deficits in recessions and then fiscal surpluses in good times. This was supposed to be virtuous anti-cyclical macroeconomics. What supposed Keynesians are doing today would have horrified Keynes. Today, governments want to keep stimulating the economy, whatever its position in the business cycle.

The biggest deficits since World War 2 were run during the Covid pandemic. This is defensible in a medical crisis. But ever since the Great Recession of 2008, Western governments have been on a non-stop stimulus spree, both fiscal and monetary. In theory, governments were frantically combating deflation. This was tilting at windmills.

It took the crazy form of negative interest rates, robbing savers of any return on savings. Cheap money fuelled stock market and real estate bubbles, not the real economy. So, billionaires grew ever richer, while workers wondered why their share of the pie was falling. Indeed, one wag declared that the Fed’s policy really was ‘Prudent investing will not be tolerated!’

It was the ideological intention of Ronald Reagan and Margaret Thatcher to shrink the state. Alas, it actually expanded under them, and has continued to expand since. Reagan had a great campaign line, that the nine most-dreaded words were, ‘I’m from the government and I’m here to help.’ He claimed that government attempts to help were the greatest long-term threat to progress. But while he shrank some parts of the state, he allowed others to expand.

Schumpeterians believe that government attempts to help, help and help again are the root cause of all that has gone wrong. They link this to declining GDP growth, angst among workers that ‘decent jobs’ are disappearing, rising inequalities, a soaring number of billionaires, rising inflation, crazy stock market valuations, Trumpist populism, protectionism and soaring fiscal deficits.

In 2022, the Bureau of Indian Standards (BIS) found that since 1990, zombie companies, narrowly defined, rose from 4% of all companies to 15% in a sample of 15 advanced countries, and to 20% in the US.

However, the Western narrative of rising inequality is contested by economist Branko Milanovic. He has pioneered international comparisons of how individuals across the world have fared in recent times. And it is a heartening story of the global poor getting better off and global inequality falling.

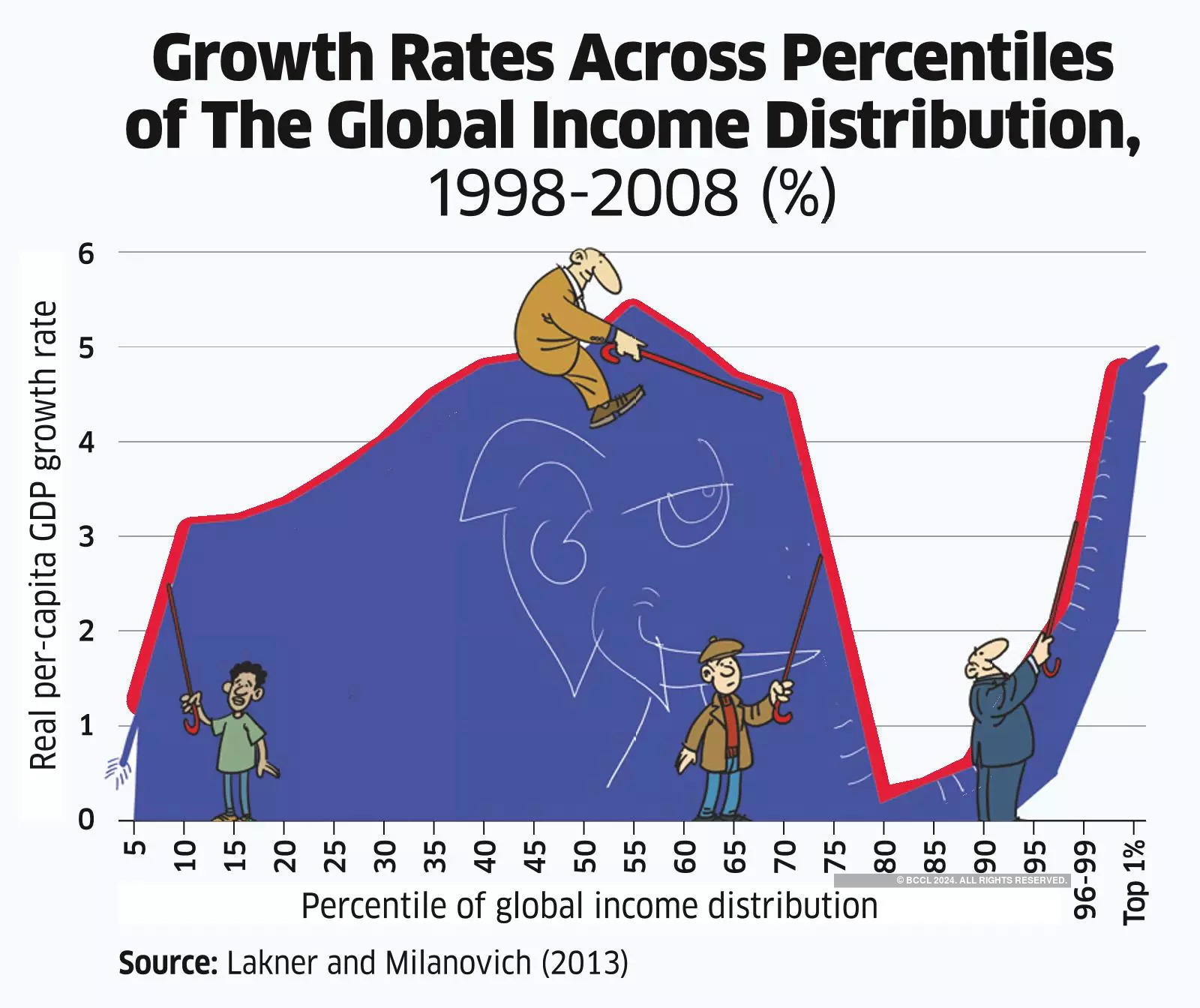

Growth Rates Across Percentiles of The Global Income Distribution, 1998-2008 (%)

NCAER economist Shekhar Aiyar has written a paper on this – ‘Income Inequality and the Liberal Economic Order: A Not Entirely Western Perspective’. He elucidates Milanovic’s famous ‘elephant’ chart (see graph) showing income changes during 1988-2008 for individuals across the world. This shows stagnation from the 75th to 95th percentiles, the resentful Westerners.

But there is huge improvement from the 10th to 70th percentiles, the vast bulk of the global population living in developing countries – not just in China and India but also countries in Africa. The trend strengthened in a later update to 2018.

So, far from widening, inequalities at the global level have shrunk. The West may not be interested in this good news. But let us in India celebrate. Capitalism has not failed at all from our viewpoint. We have greatly benefited from globalisation and freer markets. Hurrah!

(Disclaimer: The opinions expressed in this column are that of the writer. The facts and opinions expressed here do not reflect the views of www.economictimes.com.)

This article was originally published by The Economic Times on July 2 2024.